Choosing the right technology for a fintech application significantly impacts its success. React.js stands out as a powerful option, particularly suited for developing complex, responsive financial applications. This article outlines the core benefits and considerations of adopting React.js for your fintech solution.

Understanding React.js

React.js, commonly known as React, is an open-source JavaScript library for building dynamic user interfaces. Developed by Facebook, it enjoys strong community support and widespread usage among industry leaders, including fintech companies like Coinbase and Robinhood. React’s efficiency stems from its component-based architecture, virtual DOM, and clear syntax, enabling developers to build and maintain sophisticated user interfaces effortlessly.

Core Benefits of React.js in Fintech

- Scalability: React.js supports scalable application architectures that can seamlessly manage increasing user loads and changing regulatory requirements. For instance, platforms such as peer-to-peer lending apps can efficiently scale to handle large volumes of transactions and users without compromising on performance or regulatory compliance.

- High Performance: Given the critical importance of real-time data in fintech, React.js offers excellent performance through its efficient rendering capabilities. Traders on investment platforms, for instance, benefit from instantaneous updates on stock prices and seamless transaction execution, crucial during periods of high market volatility.

- Reusable Components: The component-based nature of React.js simplifies and accelerates fintech app development by allowing the reuse of code components across various functionalities, such as authentication processes, dashboards, and data visualization tools.

- Code Maintainability: React’s structured approach simplifies code management, which is vital for fintech solutions dealing with intricate calculations and financial modeling. This enhances developers’ ability to update and maintain complex codebases with ease.

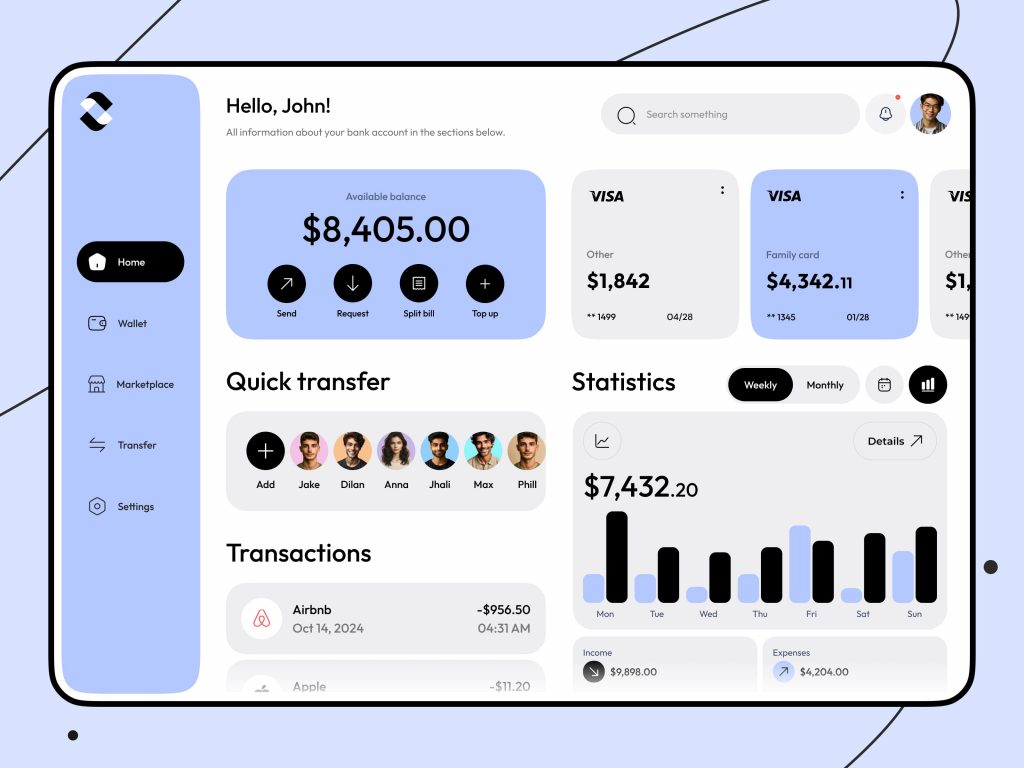

- Data Management: React.js efficiently manages and displays large and complex financial datasets, essential for apps like investment analytics platforms. Users can interact with detailed insights into market trends and portfolio performances seamlessly.

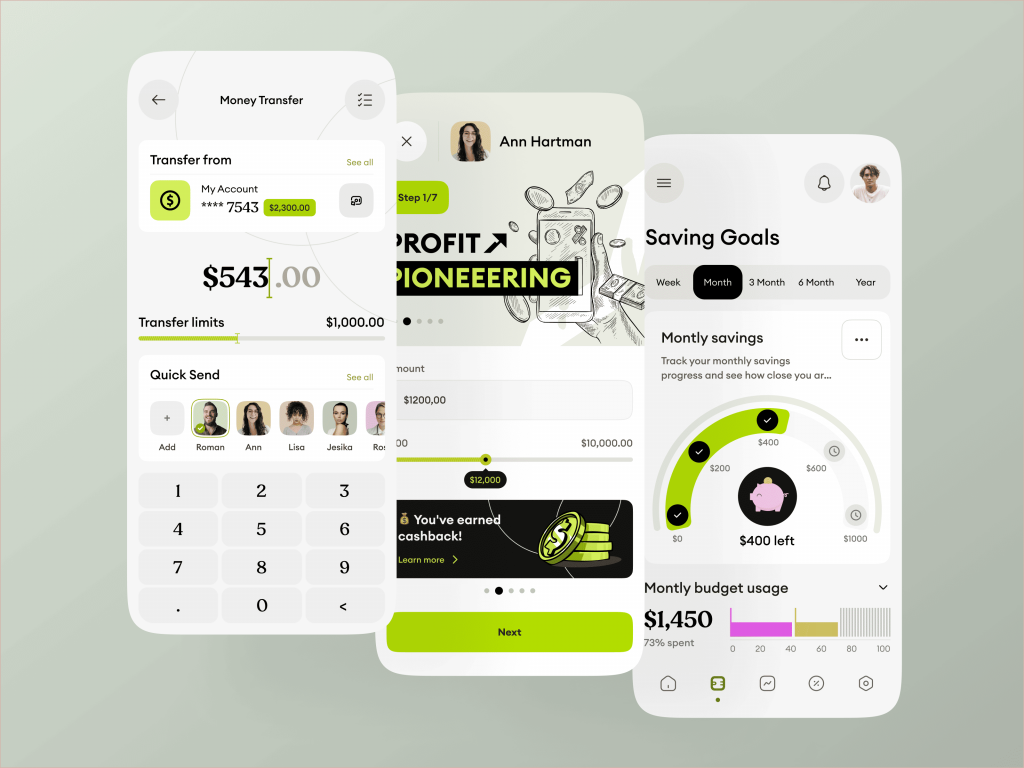

- Responsive User Interfaces: React.js ensures that fintech applications maintain high responsiveness, even under real-time data streaming conditions, significantly improving user experience, satisfaction, and engagement.

- Integration Flexibility: React.js easily integrates with third-party APIs and external data sources, essential for fintech applications such as budgeting tools and banking platforms, providing users with comprehensive financial overviews.

Challenges of Using React.js in Fintech

Despite numerous advantages, adopting React.js requires addressing several important considerations:

- Security: Fintech apps deal with sensitive user information and financial transactions. React.js alone doesn’t provide built-in security measures, making it essential to implement robust security practices such as data encryption, secure authentication, and strict access controls.

- Performance Optimization: Real-time data processing can pose performance challenges. Employing techniques such as code splitting and React’s virtual DOM optimization can help maintain high app performance.

- Integration with Legacy Systems: Many fintech companies rely on existing systems. Utilizing middleware and APIs can bridge modern React.js frontends with legacy systems, facilitating smoother transitions and interoperability.

- Cross-Browser Compatibility: Ensuring consistent functionality across different browsers is crucial. React.js provides flexibility, but developers must implement rigorous testing strategies to handle potential inconsistencies.

- Dependency Management: Managing dependencies in React.js projects can become complex. Leveraging package management tools like npm or yarn ensures systematic handling and regular updates of dependencies.

React.js for Fintech: Real-world Example

At Tino Agency, we implemented React.js for the Sparrow Student Loan platform, which is designed to connect students with optimal lending options. React.js efficiently manages real-time updates, complex data visualizations, and interactive user experiences. The result: a successful fintech solution that secured substantial investment and serves thousands of daily users.

Partner with Experienced Fintech Developers

Selecting the right technology is just the first step. The real challenge is implementation. Tino Agency’s experienced fintech developers provide the expertise required to overcome industry-specific challenges, ensuring your app complies with regulatory standards and delivers exceptional user experiences.

Schedule a call today and leverage our fintech expertise for your project’s success!

FAQ

React.js excels due to its scalability, high performance, reusable components, maintainability, and efficient handling of complex financial data, making it particularly suitable for fintech solutions.

While React.js itself doesn’t address security directly, combining React.js with robust security practices such as data encryption, secure user authentication, and regular security audits ensures a secure fintech environment.

Key strategies include using virtual DOM, code splitting, efficient component rendering, and careful dependency management to maintain high app performance and responsiveness.

Yes, React.js easily integrates with legacy systems through middleware and APIs, facilitating smoother transitions and efficient data exchange between modern frontend applications and existing backend systems.

Fintech applications require consistent performance across various browsers. Implementing comprehensive cross-browser testing and adjustments ensures seamless user experiences for all customers.