The cryptocurrency industry has grown from a niche tech experiment to a global financial force. If you’re thinking about launching your own crypto exchange platform, you’re not alone—and you’re not late. With the right product, tech stack, and strategic approach, building a crypto exchange can be a lucrative and impactful venture.

At Tino Agency, we’ve worked with Web3 startups across the globe. Here’s our complete, no-fluff guide on how to build a cryptocurrency exchange—from market research to launch and beyond.

1. Understand the Types of Crypto Exchanges

Before writing a single line of code, define your product type. Crypto exchanges fall into three major categories:

- Centralized Exchanges (CEXs): Operated by a company that holds custody of users’ funds. Think Binance or Coinbase.

- Decentralized Exchanges (DEXs): Peer-to-peer marketplaces powered by smart contracts. Popular options include Uniswap and PancakeSwap.

- Hybrid Exchanges: Combine features of CEXs (like liquidity and ease of use) with DEX principles (like self-custody).

Each comes with its own technical, legal, and business implications—so choose your model carefully based on your target audience, geography, and resources.

2. Market Research and Business Planning

You’re not just building a platform. You’re entering a highly competitive and regulated market. Your planning stage should include:

- 🔍 Competitive analysis: Study the top 5 players in your niche. Identify gaps in UI/UX, fees, supported tokens, or regions.

- 👥 Target audience definition: Will you cater to DeFi traders, institutional clients, beginners, or NFT investors?

- 🧾 Regulatory review: Understand the crypto licensing requirements in your operating jurisdictions.

- 💰 Revenue model: Trading fees, listing fees, subscription tiers, or DeFi-based income? Define how your exchange will sustain itself.

3. Choose the Right Tech Stack

Your tech stack must be secure, scalable, and efficient. A typical crypto exchange includes:

- Frontend: React, Vue, or Angular for responsive interfaces

- Backend: Node.js, Go, or Rust for high performance

- Database: PostgreSQL, MongoDB, or custom blockchain data layers

- Blockchain integrations: via APIs or nodes for Ethereum, Solana, BNB Chain, etc.

- Security layer: 2FA, encryption, DDoS protection, cold/hot wallet infrastructure

- Matching engine: Fast, efficient, and customizable for market/limit orders

At Tino, we design modular systems so exchanges can scale as user load and asset volume grow.

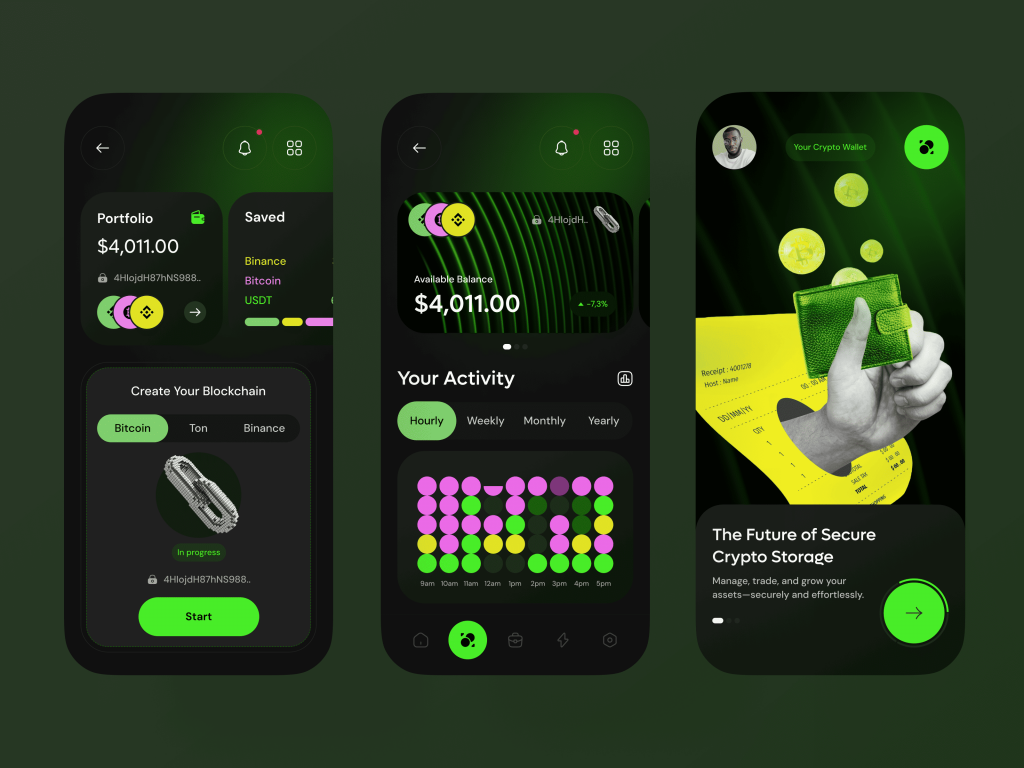

4. Key Features Your Exchange Needs

A functional crypto exchange should include:

- 🔐 User registration and KYC (if required)

- 💱 Crypto wallet integration (custodial or non-custodial)

- 📊 Trading interface with real-time data

- 📈 Market charts and order books

- 💬 Customer support modules

- ⚠️ Admin panel for transaction and user management

Optional but powerful:

- 💳 Fiat on-ramp integration (credit cards, bank transfers)

- 📱 Mobile app (iOS/Android)

- 📢 Affiliate/referral program

- 📡 API for algorithmic traders

5. Security Should Be Your Top Priority

Crypto platforms are frequent targets for cyberattacks. Your security checklist must include:

- 🔐 Multi-signature wallets and cold storage

- 🔍 Smart contract audits (if building a DEX)

- 🛡️ DDOS mitigation and SSL encryption

- 🧠 Real-time monitoring systems

At Tino, we build infrastructure-level security into the architecture from day one—not as an afterthought.

6. Legal and Compliance Setup

Compliance varies by region but often includes:

- ✅ AML (Anti-Money Laundering) and KYC procedures

- ✅ Registration with regulatory bodies (like FinCEN, FCA, or ESMA)

- ✅ Tax reporting integrations

We recommend consulting with a crypto-specific legal advisor early on. Tino can assist with regulatory research and integrations in Europe, the U.S., and UAE.

7. Testing, Auditing, and Soft Launch

Before going live:

- ✅ Run multiple test environments

- ✅ Conduct usability and stress tests

- ✅ Penetration test with a third-party cybersecurity firm

- ✅ Soft launch with a limited user base

You’ll want real feedback, but in a controlled way.

8. Launch and Post-Launch Growth

Your launch plan should include:

- 🚀 Go-to-market strategy with crypto influencers or communities

- 💼 B2B partnerships (liquidity providers, data oracles)

- 📢 PR outreach and exchange listings (CoinGecko, CoinMarketCap)

- 📈 Growth marketing (retargeting ads, Telegram campaigns, SEO)

Remember, building the platform is just 50% of the work. The other 50% is community.

FAQ: Cryptocurrency Exchange Development

It depends on features and compliance needs. MVPs start around $80k–$120k, while full-scale platforms can go beyond $300k.

A basic exchange takes 4–6 months; advanced platforms may take 9–12 months including licensing.

Not recommended. Most regions now require licenses or registration. We can help you explore your legal path.

Security, liquidity, and user trust. If users don’t feel safe or supported, they won’t trade.

Absolutely. We’ve helped multiple clients build blockchain platforms, from MVPs to production-ready solutions. Let’s talk.

Need help building your crypto exchange platform? Book a free strategy call with Tino Agency and let’s turn your idea into a secure, scalable product